Provide Dependable Commercial Finance Guidance while Maintaining your Firm’s Independence.

Specialised Commercial Finance Expertise for Clients of Forward-Thinking Public Accountants.

Distinguish your services through Specialised Commercial Finance Support.

Provide Dependable Commercial Finance Guidance while Maintaining your Firm’s Independence.

Specialised Commercial Finance Expertise for Clients of Forward-Thinking Public Accountants.

Distinguish your services through Specialised Commercial Finance Support.

Distribution

Today both bank and non-bank financiers rely on thousands of commission-only brokers and consultants to distribute their commercial finance products.

Generalists

The rush to secure deals has diluted the development of specialised expertise. As brokers and consultants aim to capture a wide range of opportunities rather than focussing on areas of specialisation.

Complexity

The surge in finance brokers has helped fuel an increase in financiers and products, creating a complex landscape that demands true specialised authority to navigate effectively.

- As the influence of finance brokers and consultants grows, some with questionable credentials, more accounting firms are feeling a need to step in and expand their services to protect client relationships.

- A quality commercial finance service requires top-tier advice for clients. Succeding in this, firms are enhancing client loyalty and attracting new business, plus generating additional revenue streams.

- Our service facilitates this move to ensure that clients receive the best advice while safeguarding firm independence and enhancing long-standing relationships.

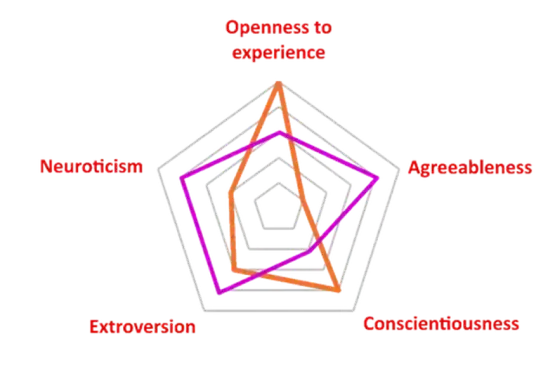

- We rigorously evaluate commercial finance brokers and consultants.

- We maintain an independent, vetted panel of subject matter experts.

- We provide transaction-based client-to-consultant matching for optimal outcomes.

- We continuously monitor and report transaction outcomes and fees to you.

- Plus, much more.

Our Services is to help you offer these services without compromising your independence or client relationships.

Access Industry Insights Directly from Experts.

Reinforce your industry knowledge from our subject matter experts.

Evaluate your current finance broker.

If your current broker is good, then we need them on our panel.

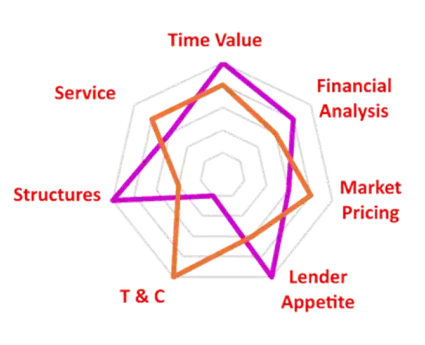

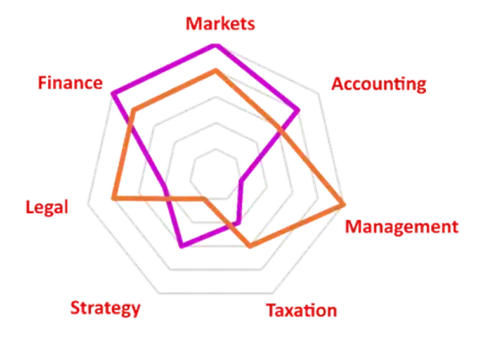

Access Our Credit Ready Benchmarking Tool.

Utilise our corporate banking tool to prepare clients for finance.

Behavioral

Business

Finance