In today’s interconnected world, international trade stands as a cornerstone of economic growth. For Australian importers and exporters, understanding the nuances of trade finance is crucial. This article delves into how bank and non-bank trade finance facilities operate, offering insights to help businesses make informed decisions.

Trade finance bridges cash flow gaps for importers and exporters. It ensures smooth transactions across borders. Businesses use tools like letters of credit, guarantees, or invoice financing. Both bank and non-bank facilities offer solutions. But how do they differ?

Globally, trade finance facilitates over 80% of international trade (World Trade Organisation, 2022). For Australian businesses, choosing the right option is critical. Let’s break it down.

How Bank Trade Finance Facilities Work

Banks provide structured trade finance services. These include letters of credit (LCs), documentary collections, and export/import loans. For example, an importer might use an LC to guarantee payment to a foreign supplier. The bank acts as a trusted intermediary. For a deep dive into LCs read our LC article.

Benefits of bank trade finance:

- Security: Reduced risk of non-payment.

- Global Networks: Access to established banking partners and international networks to facilitate cross-border transactions.

- Regulatory Compliance: Adherence to international standards with established.

However, banks often require extensive documentation. Approval times can be slow. Collateral may also be needed.

Non-Bank Trade Finance: Flexible Business Finance Alternatives

Non-bank lenders offer innovative solutions. These include supply chain finance, factoring, or merchant cash advances. Approval is often faster. Terms are more flexible.

For example, a non-bank might fund an exporter’s invoice within 24 hours. This speeds up cash flow. Non-banks also focus on niche industries. They may accept higher-risk clients.

But costs can be higher. Rates may vary based on risk assessments.

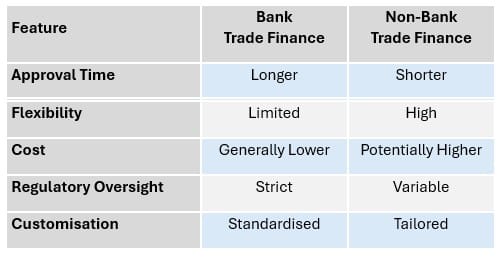

Comparing Bank vs. Non-Bank Trade Finance

- Speed: Non-banks often process applications faster.

- Cost: Banks offer lower rates but stricter terms.

- Flexibility: Non-banks tailor solutions to unique needs.

According to the Reserve Bank of Australia (2023), 34% of SMEs use alternative finance due to bank delays.

Bank Trade Product (e.g., Letters of Credit):

- Instrument Type: Documentary credit.

- Function: Guarantees payment to a seller (exporter) on behalf of the buyer (importer), assuming compliant documents are presented.

- Parties Involved: Bank, buyer, seller.

- Security: Often secured against the buyer’s credit or collateral.

- Risk Profile: Shifts performance/payment risk from buyer to the bank.

- Ideal For: International or cross-border trade where the seller demands security of payment before shipping.

Non-Bank Trade Facility (e.g., from fintech lenders or trade financiers):

- Instrument Type: Typically structured as a revolving line of credit or supply chain finance.

- Function: Finances the purchase of goods (domestic or international), sometimes also supporting deposits or progress payments to suppliers.

- Parties Involved: Borrower (buyer), supplier, financier.

- Security: Usually unsecured or backed by personal guarantees, with a lien over receivables or inventory.

- Risk Profile: Based more on borrower performance and repayment history.

- Might Include: Elements of debtor finance (receivables-backed) or inventory finance (stock-backed).

- Ideal For: SMEs needing flexibility or those unable to secure traditional bank facilities.

Comparative Analysis

Real-World Application

Scenario:

An Australian importer seeks to purchase goods from an overseas supplier but lacks immediate funds.

- Bank Solution: The importer applies for a letter of credit, ensuring the supplier receives payment upon shipment. The process, while secure, takes several weeks for approval.

- Non-Bank Solution: The importer approaches a fintech lender offering trade loans. Approval is granted within days, allowing the importer to proceed promptly.

Why Expert Business Finance Advice Matters

Navigating the complexities of trade finance requires expertise. Finance consultants play a pivotal role in:

- Strategy: Crafting financial plans to optimise trade operations.

- Assessment: Evaluating the best financing options based on business needs.

- Connection: Linking businesses with suitable lenders.

For tailored advice and to explore the best trade finance solutions, contact Convergent Capital Corp. Our experts are here to guide you through every step.

Relevant Articles from our Catalogue

- Debt Market Mirage: The Truth About Global Business Funding

- The Silent Storm: How Tariffs Wreck Economic Growth

- The Superannuation Secret: Fueling Growth in Commercial Lending

External Links to Consider

- Australian Bureau of Statistics: International Trade: Supplementary Information, Financial Year – International Trade in Goods and Services data on a financial year basis by country and state

- Australian Government, Department of Foreign Affairs and Trade – Trade in goods and services

- World Trade Organization – Trade Finance